Seriously! 23+ Facts Of Revenue Agent Report People Forgot to Share You.

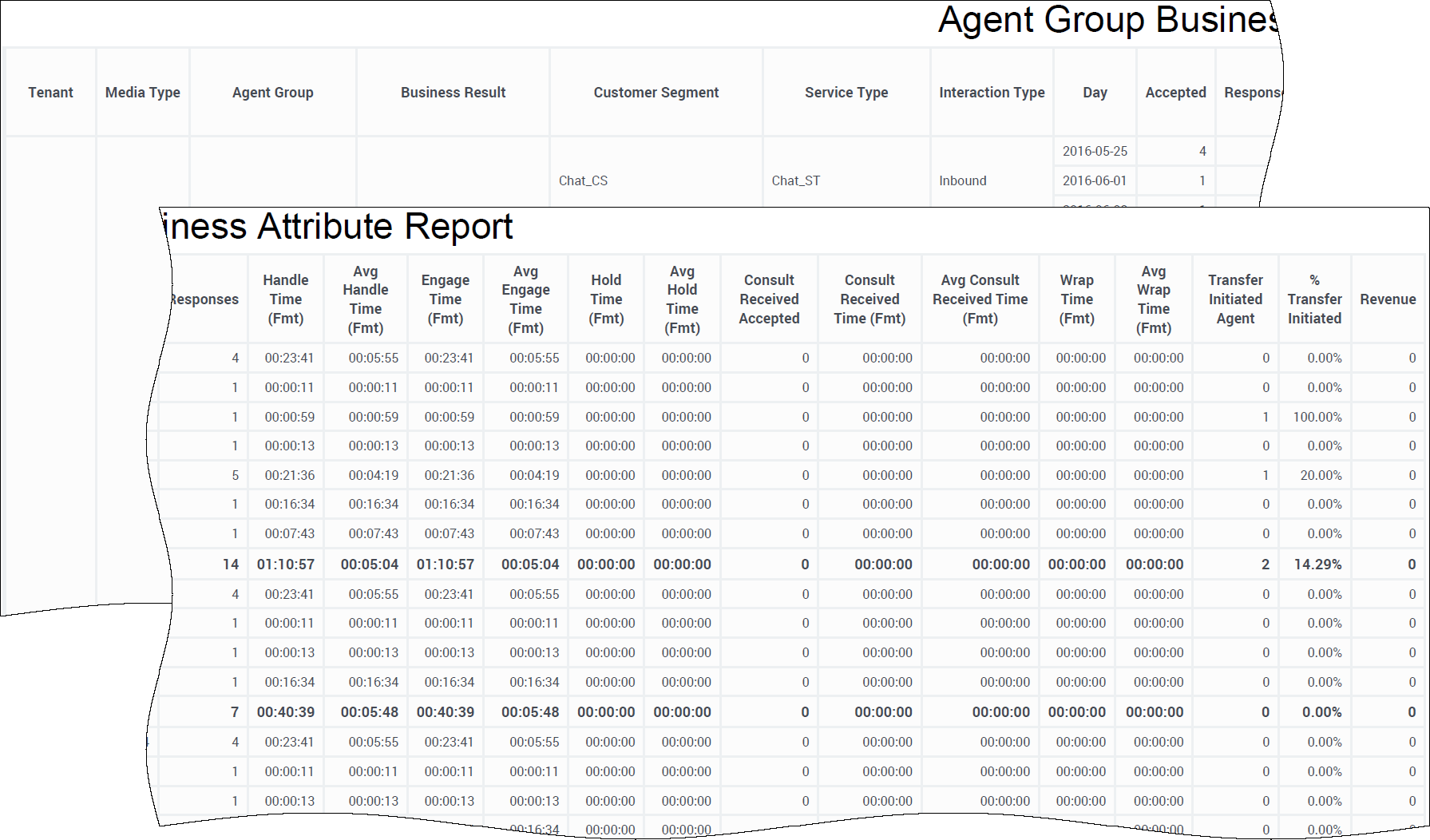

Revenue Agent Report | Enrolled agent special enrollment examination. They are listed on the left below. The rar contains information such as adjustments to the taxpayer's income, but it states the bottom. A revenue agent is someone who ensures that governments get their tax money from businesses and citizens. Revenue agent reports (rars) should contain all the information necessary to ensure a clear understanding of the adjustments and demonstrate how the tax liability was computed.

Meaning of revenue agent's report as a finance term. Should you report revenue gross as a principal or net as an agent? The revenue analysis reports include the following areas: Employment is conditional on a satisfactory report of background investigation, including a tax audit. An article titled revenue agent reporting (rar) services already exists in saved items.

The revenue analysis reports include the following areas: The revenue recognition report provides the actual amount to be recognized for each month. An irs agent's report following an audit. The new revenue standard's core principle results in the recognition of revenue when or as control of the specified goods that is, the entity is acting as an agent and recognizes revenue on a net basis. That depends on whether you are a principal or an agent. A revenue agent is someone who ensures that governments get their tax money from businesses and citizens. The internal revenue service (irs) is the revenue service of the united states federal government. Any tips on the revenue officer (not agent) interview questions ? For all meanings of rar, please click more. Meaning of revenue agent's report as a finance term. Determine tax liability or collect taxes from individuals or business firms according to prescribed laws and. Employment is conditional on a satisfactory report of background investigation, including a tax audit. They review tax returns, conduct audits, identify taxes owed.

Free essays, homework help, flashcards, research papers, book reports, term papers, history amp; The revenue recognition report provides the actual amount to be recognized for each month. The revenue agent's report (rar) shows how any adjustments made to a taxpayer's liability was calculated, including the procedures applied, tests performed, information obtained. Internal revenue service ( irs) examinations often result in changes to federal taxable income that, in turn. Should you report revenue gross as a principal or net as an agent?

For example, they may focus. Free essays, homework help, flashcards, research papers, book reports, term papers, history amp; Agent revenue analysis in usd. The rar contains information such as adjustments to the taxpayer's income, but it states the bottom. Besides revenue agent report, rar has other meanings. They are listed on the left below. That depends on whether you are a principal or an agent. Liveagent offers an agent report of work time, answered tickets, chats, calls, sales, rewards, and more (see all options below) from a specific time range. Liveagent offers you perfect agent report. The internal revenue service (irs) is the revenue service of the united states federal government. An irs agent's report following an audit. Internal revenue agent series, 0512. Revenue agent reports (rars) should contain all the information necessary to ensure a clear understanding of the adjustments and demonstrate how the tax liability was computed.

Enrolled agent special enrollment examination. An irs agent's report following an audit. Employment is conditional on a satisfactory report of background investigation, including a tax audit. Determine tax liability or collect taxes from individuals or business firms according to prescribed laws and. The revenue recognition report provides the actual amount to be recognized for each month.

Your revenue agent's reports convey taxes and critical finances that need careful management. The revenue analysis reports include the following areas: Meaning of revenue agent's report as a finance term. A revenue agent is someone who ensures that governments get their tax money from businesses and citizens. The government agency is a bureau of the department of the treasury, and is under the immediate direction of the commissioner of internal revenue. Internal revenue service ( irs) examinations often result in changes to federal taxable income that, in turn. The revenue recognition report provides the actual amount to be recognized for each month. That depends on whether you are a principal or an agent. Should you account for revenues on a net basis or on a gross basis? Promptly upon receipt thereof, copies of all revenue agent reports (internal revenue service form 886), or other written proposals of the internal revenue service, that propose, determine or otherwise. Internal revenue agent series, 0512. The new revenue standard's core principle results in the recognition of revenue when or as control of the specified goods that is, the entity is acting as an agent and recognizes revenue on a net basis. Liveagent offers an agent report of work time, answered tickets, chats, calls, sales, rewards, and more (see all options below) from a specific time range.

Revenue Agent Report: The rar contains information such as adjustments to the taxpayer's income, but it states the bottom.

Source: Revenue Agent Report

0 Response to "Seriously! 23+ Facts Of Revenue Agent Report People Forgot to Share You."

Post a Comment