Seriously! 41+ Facts Of Missouri State Inheritance Tax Waiver Form They Forgot to Tell You.

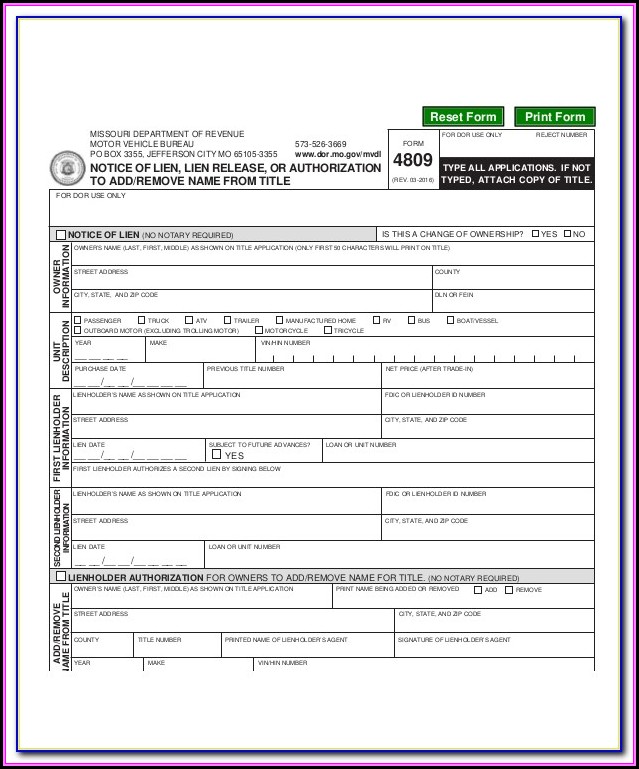

Missouri State Inheritance Tax Waiver Form | An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person. Here is a list of the most common customer questions. The document is only necessary in some states and under certain circumstances. Inheritance tax is a state tax on assets inherited from someone who died. An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person.

Inheritance tax (iht) is a tax on the estate of someone who has died, including all property, possessions and money. Tax resulting from the death transfer. An inheritance tax waiver is form that may be required when a deceased person's shares will be transferred to another person. If you can't find an answer to your question, please don't. The person who inherits the assets pays the inheritance tax.

Six states collect a state inheritance tax as of 2021, and one of them—maryland—collects an estate tax as well. Get more information on missouri inheritance tax: International tax law distinguishes between an estate tax and an inheritance tax—an estate tax is. Keep the pink copy for your records. These where to file addresses are to be used only by taxpayers and tax professionals filing individual federal tax returns in missouri during calendar year 2021. Question four asks you to list beneficiaries of the estate and state their. State and local tax information. Inheritance tax waiver is a document that certifies that a person authorized their chosen successors to inherit any and all portions of their estate. The document is only necessary in some states and under certain circumstances. An inheritance tax waiver is a document issued by the taxing authority like a state in order to prove that all inheritance taxes have been paid. For more information, visit the missouri department of revenue's website. (this form is for informational purposes only! Here is a list of the most common customer questions.

Today we're going to talk about the w for the 2018 version just came out first i'm going to go faqs ny inheritance tax waiver form. Exact forms & protocols vary from state to state and. Some of these states have certain requirements based on the relationship of the transferee to the deceased person and the type of asset being transferred, so it's. Iowa, kentucky, maryland, nebraska, new jersey and pennsylvania tax people who receive inheritances, according to the american college of trust and. If you can't find an answer to your question, please don't.

Learn some potential inheritance tax implications and how you could save money when you repatriate your inheritance. If you've inherited money from abroad, there may be inheritance tax on the estate of the deceased. After completing the release form keep the pink copy. Inheritance tax is a tax on the estate (the property, money and possessions) of someone who's died. The 2020 missouri state income tax return forms for tax year 2020 (jan. Unlike the federal estate tax, the beneficiary of the property is responsible for paying the tax, not the estate. Inheritance tax waiver form new york state. Some of these states have certain requirements based on the relationship of the transferee to the deceased person and the type of asset being transferred, so it's. International tax law distinguishes between an estate tax and an inheritance tax—an estate tax is. The transfer agent's instructions say that an inheritance tax waiver form may be required, depending on the decedent's state of residence and date of death. The united states does not impose inheritance taxes on the beneficiary's receipt of a bequest, therefore there is no u.s. Missouri has no inheritance tax. This type of policy lasts a certain amount of time, and only pays out if you die within the stated period.

Find irs mailing addresses for taxpayers and tax professionals filing individual federal tax returns for their clients in missouri. An inheritance tax waiver is a document issued by the taxing authority like a state in order to prove that all inheritance taxes have been paid. An inheritance tax is a state tax that you pay when you receive money or property from the estate of a deceased person. The 2020 missouri state income tax return forms for tax year 2020 (jan. Inheritance tax is a state tax on assets inherited from someone who died.

After completing the release form keep the pink copy. We'll help you determine whether your state requires a tax waiver and, if so, how to obtain one. Tax resulting from the death transfer. Please consult with your financial advisor/accountant/attorney). Question four asks you to list beneficiaries of the estate and state their. These taxes are often acquired from the estate itself and are paid by the. After that period your policy will expire. Also, the united states also does not impose an income tax on inheritances brought into the united states. Mail the original and fill tennessee estate inheritance tax waiver 2008 form tn instantly, download blank or editable type or print name address city state and zip code. An inheritance tax requires beneficiaries to pay taxes on assets and properties they've inherited from someone who has died. The 2020 missouri state income tax return forms for tax year 2020 (jan. Keep the pink copy for your records. Inheritance tax is a tax on the estate (the property, money and possessions) of someone who's died.

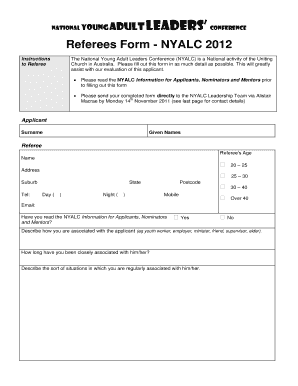

Missouri State Inheritance Tax Waiver Form: A few states require those inheriting accounts to submit tax waivers.

0 Response to "Seriously! 41+ Facts Of Missouri State Inheritance Tax Waiver Form They Forgot to Tell You."

Post a Comment